More and more people seem to be deciding to give Costa Rica a try as their new home these days. And many are still of working age (not retired) and in search of their next big endeavor. If you have read some of our Moving to Costa Rica articles, you know that life in a new country comes with both its challenges and rewards. The same holds true for starting a business. In this post, we’ll give some insight into starting a business in Costa Rica.

Why Start a Business in Costa Rica?

There are many reasons why an expat would want to start a business in Costa Rica, but the biggest one is obvious — income! If you are not already receiving some type of steady income like retirement or from an online job, you need to figure out how to support yourself.

Visa Requirements for Working as a Foreigner

Simply working as an employee in Costa Rica is not an easy option. This is because as a foreigner, you are not allowed to work without a special visa unless you have citizenship or a particular residency status called permanent residency. You can apply for permanent residency by having a first-degree kinship to a Costa Rican (e.g., through the birth of a child). But most people get it after having temporary residency first for three years.

Otherwise, most people who move to Costa Rica would need to get a visa to work. These can be hard to get because the government does not want to take jobs away from locals. Visas sometimes can be obtained for specialized fields like scientists, professors, and things like that. But for an employer to get a work visa for a foreigner, they would have to show that the job is something that no local is able to do. Therefore, it can’t be for a regular job like construction, mechanic, restaurant server, etc.

This doesn’t mean that you don’t find foreigners without permanent residency or citizenship working in Costa Rica, though. Working without the proper documents is somewhat common here, especially in more rural areas. But doing so is risky and could get you deported.

Wages in Costa Rica

Another reason to start your own business is that wages are typically low here. Therefore, even if you do obtain permanent residency (which can take years) and are able to work for someone else, most jobs don’t pay what you would expect. At least in relation to your home country’s standards. Many workers in Costa Rica, even skilled ones like plumbers or dental assistants, make only around $2.00-$5.00 USD per hour.

For more information on specific professions, you can check out Costa Rica’s 2020 minimum wage guidelines here.

Opening a Business in Costa Rica

Owning a business is something that is permitted as a foreigner, even without any type of residency status.

In general, you can own and operate your own business with only a tourist visa. When doing so, you must hire locals for the actual labor, but you can do the management and related tasks. Later, if you do obtain permanent residency or citizenship, you can be much more involved in other parts of the business as well.

Background – Our Experience

We set up a Costa Rican corporation in 2016 as a part our existing travel agency and hired a lawyer in Costa Rica to do the paperwork. When doing so, we remember having so many questions that it was almost overwhelming. Jenn is a lawyer in the United States so that helped, but we still had a lot of unknowns.

As our lawyer guided us through the options, we found that much of the process for opening a business in Costa Rica is the same as it was in our home country. We had recently set up a corporation in the United States too, so many of the requirements and steps overlapped.

Steps for Starting a Business in Costa Rica

Some businesses are more complicated than others so this won’t be a complete list for everyone. But many of the core steps for starting a business in Costa Rica are the same. So this should give you an idea of what to expect.

Disclaimer: We are not experts in business law in Costa Rica and are not intending to give legal or other professional advice. If you are opening a business, we strongly recommend that you seek the advice of a legal professional.

Pick a Business Structure

Much like other countries, Costa Rica has different business structures that vary in terms of complexity, number of people involved, and liability protection. There are a handful of different types, but here are the two most common.

Sociedad Anonima (Anonymous Society) or S.A.

This business form is similar to a corporation in the United States. To form an S.A., you need several people, including at least two shareholders, three board members, a controller, and a resident agent (attorney). The duties can overlap in some cases so, for example, a shareholder also can be a board member.

Sociedad de Responsabilidad Limitada (Society of Limited Responsibility) or S.R.L.

This is like a limited liability company (L.L.C.) in the United States. Forming an S.R.L. is much simpler since you only need two people to be shareholders, no board of directors or controller, and usually no resident agent.

Decide on a Legal Name

In Costa Rica, a legal name can be the same name you call your business or it can be something completely different. For example, if you open a restaurant, the legal name may not have anything to do with the name on the sign. Some names are even a series of numbers or special date written out. The legal name you choose cannot be too similar to an existing business in the government database.

Get Business Licenses and Permits

Depending on the type of business you are starting, you may be required to apply for a variety of licenses and permits. For a business with a physical location, you may need an occupancy permit from the health department and/or business license from the local municipality. An experienced business attorney should be able to walk you through what is needed for your specific business.

Shareholder Declaration and Digital Signature

Each year, it is mandatory to make a declaration of your business’ shareholders and/or beneficial owners to the Central Bank. Along with this requirement, you will need something called a digital signature (firma digital). The digital signature is a card that is used to electronically sign documents and can be applied for at an approved bank.

Other Important Factors in Starting a Business

Taxes

Another big step with starting a business in Costa Rica is getting set up with the Ministerio de Hacienda, which is the country’s tax authority. Your lawyer will register you with the Hacienda using your business’ legal name and corporate ID number (called a cedula juridica in Spanish).

Corporate Taxes

Once you are in the government system, you will be subject to corporate taxes and an annual corporation fee. The corporation fee is between $175-400 for an active corporation, depending on gross income.

The corporate tax rate in Costa Rica is 30%. But there are special provisions for small businesses with less than around $191,000/year in gross income. These provisions can lower the tax rate to 10-20%. Here’s a link to a website with more specific information on those other provisions.

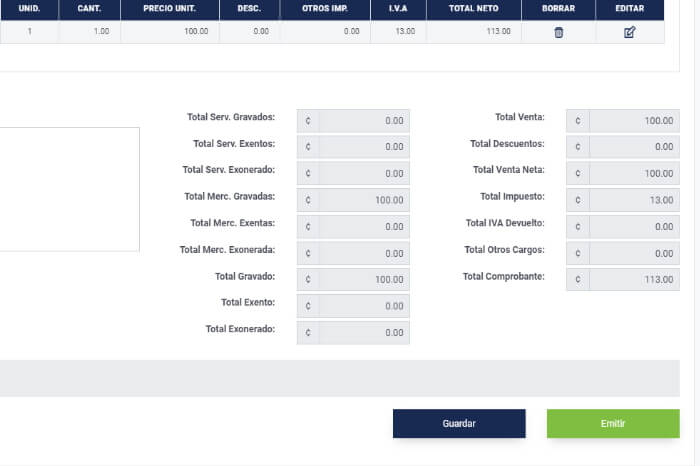

VAT (Value Added Tax)

In addition to corporate taxes, your business will most likely need to collect the VAT (value added tax), called IVA (Impuesto sobre el Valor Agregado) in Spanish. This was implemented in Costa Rica in July 2019 and was kind of a big deal. It’s a 13% tax on the total of goods and services. Some exceptions apply, but the majority of businesses are subject to this tax. Here’s a link to the Hacienda’s website with more information.

As a business, you need to collect the VAT and send monthly payments to the Hacienda. A monthly tax filing is also required. Keep in mind that unless you can figure out how to do the tax filings yourself, you will need to hire an accountant. At the time of this writing, our accountant was charging about $65 USD per month to take care of this. That fee also included the end of the year tax filing.

Other Taxes

Along with corporate taxes, you’ll need to pay an annual tax that goes towards education and culture called the Timbre de Educación y Cultura. It’s a small amount (around $20 max) but important to remember. Also be sure to check with your attorney to see if there are any municipal taxes that apply to your business.

Electronic Invoicing

Related to the monthly tax filings of the IVA (above), you will need to be able to issue and receive electronic invoices/receipts. This can be a confusing and tedious process, so it is best to consult with an accountant. They will set you up with an online invoicing system and teach you how to use it. There are several options that private companies offer and a free government system.

Basically, the way it works is that all expenses, sales, taxes, and VAT amounts need to be recorded in your electronic invoicing system. To do that, generally you need to issue an electronic invoice for anything you sell. You also need to receive one in the system for anything you buy (major purchases). The invoicing system then sends the information to the government’s database. Those corresponding values will be used to file your monthly, quarterly, and annual taxes.

At the end of the tax year, other companies and individuals that did a lot of business with you may ask to compare their electronic invoicing reports against yours. This is to make sure you are both reporting the same amounts to the Hacienda so as to avoid any tax issues. Adjustments can be made, but it is best to keep up with your electronic invoicing throughout the year to avoid headaches later.

Employees

Like most employers around the world, in Costa Rica you are subject to government regulations when it comes to your workers. The biggest financial obligation is that you must contribute towards each employee’s government healthcare costs (CCSS). You are also responsible for deducting the employee’s contribution from their pay and passing it onto the government. Each employee’s taxes also must be deducted from their pay and passed onto the Hacienda.

There are many other requirements for full time employees such as paid holidays, vacation pay, annual bonuses, and other topics that an experienced attorney can walk you through.

Banking

After officially inscribing your business and receiving your corporate ID (cedula juridica), you’ll want to open a business bank account. This is possible as a foreigner, even without any type of residency, but has its limitations.

When we opened our business bank account, for example, we did not have our permanent residency yet. It was in process. Because we had only foreign passport numbers to open the accounts, we were not allowed to bank online. We think this was to prevent fraud.

What it meant for us, though, was that all bank transfers needed to be done in person at the bank. We often had a lot of transactions to make, sometimes multiple times per week. This meant a lot of time at the bank, waiting in line and then waiting for each transaction to be processed by the teller. Once we received our residency and updated our accounts with our corresponding DIMEX (cedula) numbers, online banking made things a lot easier.

Different banks have different requirements for opening an account. But all require an accountant to provide a cash-flow projection for your company. Opening our bank account at Banco de Costa Rica in 2016 was relatively straightforward once we had our accountant make that document.

Timeline to Incorporate a Business in Costa Rica

While many of the steps involved in starting a business in Costa Rica can happen quickly, putting it all together and getting everything checked off the list can take around 2-3 months. There will no doubt be some holiday or glitch in the system that will delay you, so count on a few months or even more if you need special licenses or permits. Administrative tasks in Costa Rica can take a lot longer than expected, so be sure to exercise patience. Check out our post about Applying for Residency and you will see that we waited a long time for that too!

Takeaways

When we opened our Costa Rican corporation, we were completely overwhelmed by the process. Once we met with our attorney and knew the steps, though, we started laying out our plan and began feeling a lot more confident. We’d highly recommend hiring a lawyer that is easy to communicate with and fully bilingual so that you understand everything going on. Our attorney even translated the documents to English for us before we signed, since our Spanish isn’t perfect.

Ultimately, opening a business in Costa Rica was an adventure for us. We used it successfully for several years until our overall business structure changed and we shifted things back to our original corporation in the United States.

In the process of opening and running the Costa Rica part, however, we learned a lot about the intricacies of doing business in Costa Rica. It wasn’t all good or all bad but somewhere in between. Just like anywhere in the world, there are things that come easy and things that come hard.

One of the bigger challenges for us was the new VAT/IVA. We found it to be very costly in terms of the actual percentage that we had to pay as well as the associated accounting costs and manpower required to comply with it. Since the VAT is new, everyone is still getting used to it, even now, so maybe things will become more streamlined in the near future.

We hope this post gets you started on opening your business in Costa Rica and we wish you much success!

Have a question about starting a business in Costa Rica? Leave a comment below.

Looking for more information on moving to and living in Costa Rica? Check out these resources:

Frequently Asked Questions About Moving to Costa Rica – If you are considering a move to Costa Rica, check out this post with some of the most frequently asked questions.

Moving to Costa Rica Checklist – Getting more serious about a move abroad? Read our checklist to see how to prepare for the big jump. This list starts the planning process months in advance.

Video Chat Service – Have a question about moving to, living in, or even starting a business in Costa Rica? Chat with us for an hour to get the ball rolling.

Buying a Car in Costa Rica – One of our most popular posts about living in Costa Rica. Buying a car in a foreign country can be an adventure, so check out our experience here.